Cloudwalk has made a number of significant functional breakthroughs in this field:

The model can automatically search and mine features. With the search strategy manually configured, the model is able to automatically process and screen features to find the most effective feature combination, and apply the automatic feature engineering to mine feature combinations and bin the features, without manually selecting the features and adjusting the binning. Users only need to define the search range of model parameters, and the algorithm can automatically search and adjust the optimal model parameters. Using the decision-making tree for feature extraction, this model is characterized by strong nonlinear feature fitting ability. Experiments on multiple datasets show that with an effect similar to that of other models established based on the decision-making tree algorithm, e.g. LGB and XGB, this model can output the risk value corresponding to each feature and feature combination and then deploy these values through the decision-making engine.

Background and challenges

-

Driven by consumption upgrading, policy support, and the development of financial technology, the demand for personal consumption credit is strong

Driven by consumption upgrading, policy support, and the development of financial technology, the demand for personal consumption credit is strong -

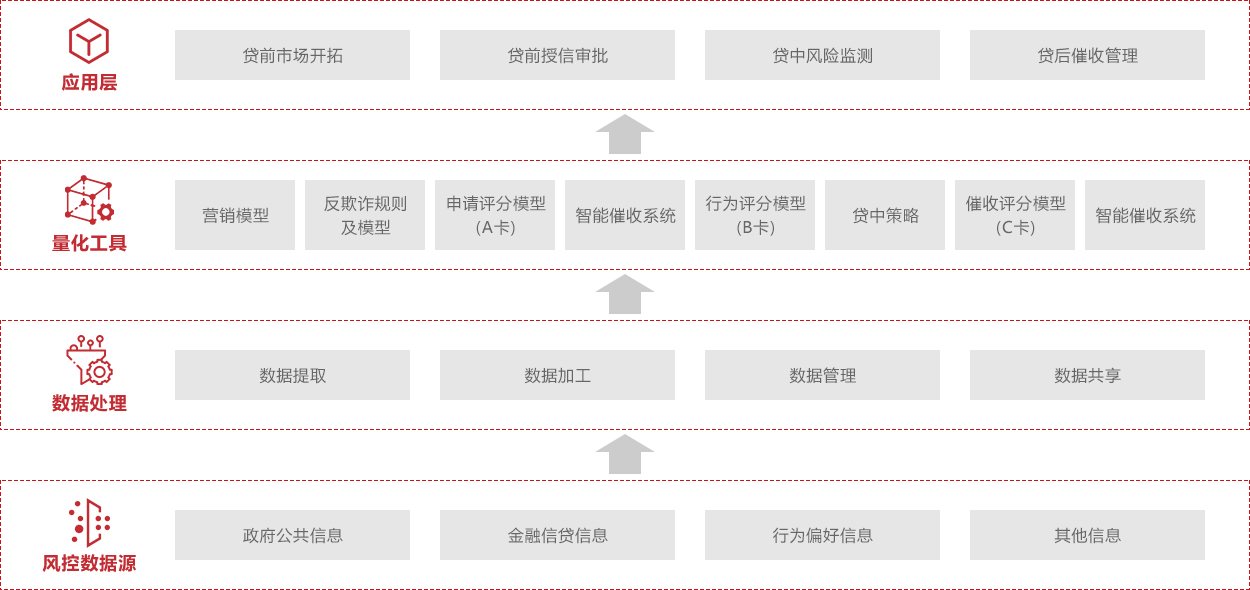

Promote consumption growth and enhance the level of inclusive financial services through intelligent risk management and control measures

Promote consumption growth and enhance the level of inclusive financial services through intelligent risk management and control measures